CoinDesk State of Bitcoin 2014

- 1. State of Bitcoin 2014 26 February 2014

- 2. Contents 1. Overview Page 3 . 2. Price and Valuation Page 14 3. Media and Brand Page 23 4. Ecosystem Page 34 5. VC and M&A Page 49 6. Technology and Mining Page 61 7. Regulation and Risk Factors Page 69 8. Other Alt-currencies Page 77 9. Appendix Page 88 2

- 3. Overview 3

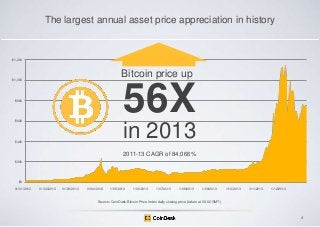

- 4. The largest annual asset price appreciation in history $1,200 Bitcoin price up $1,000 56X $800 $600 in 2013 $400 2011-13 CAGR of 84,066% $200 $0 01/01/2013 01/02/2013 01/03/2013 01/04/2013 1/05/2013 1/06/2013 1/07/2013 1/08/2013 1/09/2013 1/10/2013 1/11/2013 1/12/2013 Source: CoinDesk Bitcoin Price Index daily closing price (taken at 00:00 GMT) 4

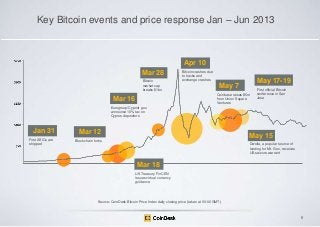

- 5. Key Bitcoin events and price response Jan – Jun 2013 Apr 10 Mar 28 Bitcoin market cap breaks $1bn Bitcoin crashes due to hacks and exchange crashes May 17-19 May 7 Coinbase raises $5m from Union Square Ventures Mar 16 First official Bitcoin conference in San Jose Eurogroup/Cypriot gov. announce 10% tax on Cyprus depositors Jan 31 First ASICs are shipped Mar 12 May 15 Block chain forks Dwolla, a popular source of funding for Mt. Gox, receives US seizure warrant Mar 18 US Treasury FinCEN issues virtual currency guidance Source: CoinDesk Bitcoin Price Index daily closing price (taken at 00:00 GMT) 5

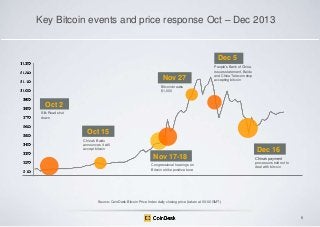

- 6. Key Bitcoin events and price response Oct – Dec 2013 Dec 5 Nov 27 People‟s Bank of China issues statement, Baidu and China Telecom stop accepting bitcoin Bitcoin breaks $1,000 Oct 2 Silk Road shut down Oct 15 China‟s Baidu announces it will accept bitcoin Dec 16 Nov 17-18 Congressional hearings on Bitcoin strike positive tone China‟s payment processors told not to deal with bitcoin Source: CoinDesk Bitcoin Price Index daily closing price (taken at 00:00 GMT) 6

- 7. Venture capital interest in Bitcoin is growing Total VC investment in cryptocurrency startups of > $98M $25M Largest VC deal to date (Series B) in November 2013 7

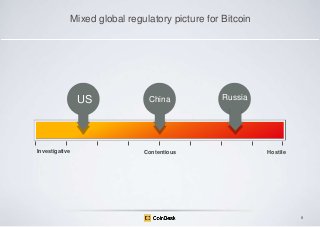

- 8. Mixed global regulatory picture for Bitcoin US Investigative China Contentious Russia Hostile 8

- 9. Bitcoin‟s ecosystem is evolving rapidly with many new entrants Battle for bitcoin exchange supremacy Mt. Gox was dethroned by BTC China, which was then dethroned by Bitstamp 9

- 10. Bitcoin‟s progress as medium of exchange vs store of value Early interest in bitcoin was primarily as an investment asset $ Recently there has been growing merchant/consumer adoption Time 10

- 11. Bitcoin teething pains still garner widespread media attention 11

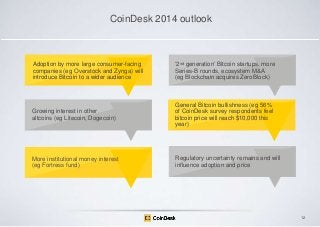

- 12. CoinDesk 2014 outlook Adoption by more large consumer-facing companies (eg Overstock and Zynga) will introduce Bitcoin to a wider audience „2nd generation‟ Bitcoin startups, more Series-B rounds, ecosystem M&A (eg Blockchain acquires ZeroBlock) Growing interest in other altcoins (eg Litecoin, Dogecoin) General Bitcoin bullishness (eg 56% of CoinDesk survey respondents feel bitcoin price will reach $10,000 this year) More institutional money interest (eg Fortress fund) Regulatory uncertainty remains and will influence adoption and price 12

- 13. As big as the PC and Internet? ― Eventually mainstream products, companies and industries emerge to commercialize it; its effects become profound; and later, many people wonder why its powerful promise wasn’t more obvious from the start. What technology am I talking about? Personal computers in 1975, the Internet in 1993, and – I believe – Bitcoin in 2014. - Marc Andreessen, Andreessen Horowitz ‖ 13

- 14. Price and Valuation 14

- 15. CoinDesk Bitcoin Price Index: 2013 by the numbers 2013 Open $13.51 2013 Close $756.79 2013 % Δ 5,507% 2013 YE Market Cap $9.2bn 2013 High (4 Dec) $1,147.25 2013 Low (2 Jan) $13.28 2013 Average $188.58 2013 Median $112.01 Source: CoinDesk Bitcoin Price Index 15

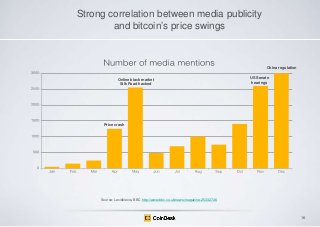

- 16. Strong correlation between media publicity and bitcoin‟s price swings China regulation Online black market Silk Road hacked US Senate hearings Price crash Source: LexisNexis, BBC http://www.bbc.co.uk/news/magazine-25332746 16

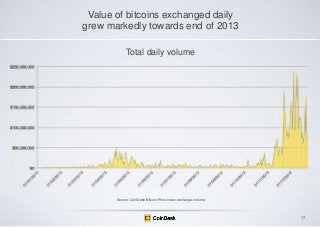

- 17. Value of bitcoins exchanged daily grew markedly towards end of 2013 Total daily volume Source: CoinDesk Bitcoin Price Index exchange volume 17

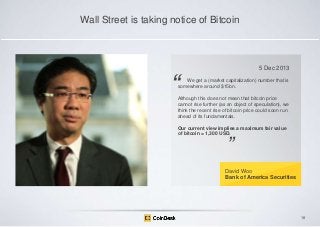

- 18. Wall Street is taking notice of Bitcoin 5 Dec 2013 ― We get a (market capitalization) number that is somewhere around $15bn. Although this does not mean that bitcoin price cannot rise further (as an object of speculation), we think the recent rise of bitcoin price could soon run ahead of its fundamentals. Our current view implies a maximum fair value of bitcoin = 1,300 USD. ‖ David Woo Bank of America Securities 18

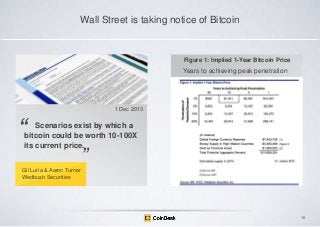

- 19. Wall Street is taking notice of Bitcoin Figure 1: Implied 1-Year Bitcoin Price Years to achieving peak penetration 1 Dec 2013 ― Scenarios exist by which a bitcoin could be worth 10-100X its current price. ‖ Gil Luria & Aaron Turner Wedbush Securities 19

- 20. Ancillary Bitcoin financial services Hedge funds – Exante ($45m AUM), Pantera Bitcoin Advisors (Fortress; $150m AUM) Bitcoin Exchange Traded Funds (ETFs) – Winklevoss Twins, and others Investment Trusts - SecondMarket Bitcoin Investment Trust (BIT) has amassed $61.1m (67,300 BTC) as of Dec 2013 Derivatives exchanges – Predictious (Ireland), ICBIT (Russia); German bank Fidor recently announced interest 20

- 21. Bitcoin now 20x larger market cap than closest altcoin, up from 10x in December Bitcoin represents 76% of total altcoin market cap Market capitalization $7.3bn - bitcoin $9.6bn - all altcoins Source: CoinMarketCap.com 20 Feb 2014 21

- 22. Bitcoin aiming to disrupt an industry with $314bn+ in total market cap Processors Market Cap Money Transfer/ATMs Market Cap Visa Inc MasterCard Inc Alliance Data Systems Corp Total System Services Inc Global Payments Inc Euronet Worldwide Inc Heartland Payment Systems Inc Netspend Holdings Inc Green Dot Corp 112,253 97,690 12,615 6,213 4,822 2,325 1,814 1,158 912 Western Union Co 9,421 Euronet Worldwide Inc 2,325 Cardtronics Inc 1,936 MoneyGram International Inc 1,061 TOTAL 239,803 Payment Hardware TOTAL 69,682 Market Cap NCR Corp MICROS Systems Inc Bank Software Market Cap 5,837 4,391 VeriFone Systems Inc 2,898 Fidelity National Information Services Inc 15,436 Diebold Inc 2,119 Fiserv Inc 15,118 Outerwall Inc 1,904 Jack Henry & Associates Inc 5,115 INGENICO 1,454 ACI Worldwide Inc 2,433 WINCOR-NIXDORF 1,006 S1 Corp 577 Online Resources Corp 146 TOTAL 38,824 RETALIX LTD Agilysys Inc ON TRACK INNOVATIONS LTD TOTAL 732 333 116 20,789 Source: CoinDesk, Wedbush Securities. Market caps ($m) as of 10 Jan 2014 22

- 23. Media and Brand 23

- 24. In 2013, the narrative surrounding Bitcoin began shifting From this … 24

- 25. In 2013, the narrative surrounding Bitcoin began shifting (contd.) To this … Bitcoin “may hold promise” ―Economists say smallbusiness owners — especially farmers dealing in high volume and low profit margins — are more likely to accept a volatile currency like bitcoin than bigger businesses.‖ 25

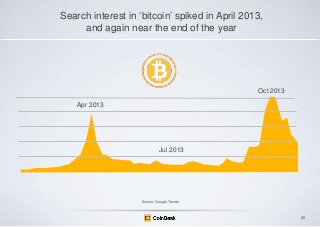

- 26. Search interest in „bitcoin‟ spiked in April 2013, and again near the end of the year Oct 2013 Apr 2013 Jul 2013 Source: Google Trends 26

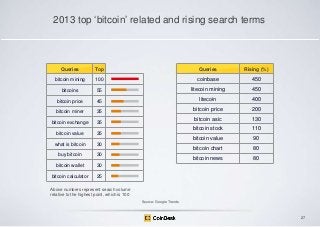

- 27. 2013 top „bitcoin‟ related and rising search terms Queries Top Queries Rising (%) bitcoin mining 100 coinbase 450 bitcoins 55 litecoin mining 450 bitcoin price 45 litecoin 400 bitcoin miner 35 bitcoin price 200 bitcoin exchange 35 bitcoin asic 130 bitcoin stock 110 bitcoin value 90 bitcoin chart 80 bitcoin news 80 bitcoin value 35 what is bitcoin 30 buy bitcoin 30 bitcoin wallet 30 bitcoin calculator 25 Above numbers represent search volume relative to the highest point, which is 100 Source: Google Trends 27

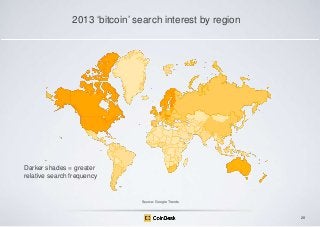

- 28. 2013 „bitcoin‟ search interest by region Darker shades = greater relative search frequency Source: Google Trends 28

- 29. 2013 „bitcoin‟ search interest by location Queries Top Queries Top Estonia 100 Vancouver 100 Netherlands 96 Amsterdam 99 Hong Kong 88 San Francisco 90 Czech Republic 88 Austin 79 Finland 87 New York 73 United States 79 Toronto 71 Canada 77 San Diego 69 Slovenia 76 Seattle 68 Sweden 74 Stockholm 66 Slovakia 72 Sydney 63 Numbers represent search volume relative to the highest point, which is 100 Source: Google Trends 29

- 30. Bitcoin is becoming something people can see and touch 30

- 31. Bitcoin has gained a foothold in pop culture ― The first time in history that you could see someone holding up a sign, in person or on TV or in a photo, and then send them money with two clicks on your smartphone. Bitcoin is a financial technology dream come true for even the most hardened anti-capitalist political organizer. College football TV payday: $24,000 ‖ - Marc Andreessen Source: http://www.dailymail.co.uk/news/article-2516708/Savvy-student-gets-24-000-strangers-holding-sign.html 31

- 32. The number of noteworthy Bitcoin conferences … 2013 May Jul Sep Dec Bitcoin 2013 BTC London Inside Bitcoins The Future of Payments London, UK European Bitcoin Convention San Jose, US New York, US Inside Bitcoins Las Vegas, US Amsterdam, The Netherlands 32

- 33. … has increased significantly in 2014 2014 Jan 25th Feb 12th North American Bitcoin Conference Inside Bitcoins Berlin, Germany Miami, USA Mar 3 – 7th Financial Cryptography and Data Security 2014 Mar 5 – 6th Mar 25 – 26th 2014 Texas Bitcoin Conference CoinSummit San Francisco, US Austin, US Barbados Apr 7 – 8th Apr 11th May 15 – 17th Jun 20 – 22th Nov 2 – 6th Inside Bitcoins NYC Bitcoin Expo 2014 Bitcoin 2014 Bitcoin in the Beltway Money2020 New York, US Toronto, Canada Amsterdam, The Netherlands Las Vegas, US Washington DC, US 33

- 34. Ecosystem 34

- 35. Bitcoin companies can be grouped into distinct categories Payment processors Mining hardware Mining hardware Financial services Exchanges Wallets Unknown 35

- 36. Top bitcoin exchanges by volume China Rest of World Sources: CoinDesk, Bitcoincharts.com, Bitcoinity.org 36

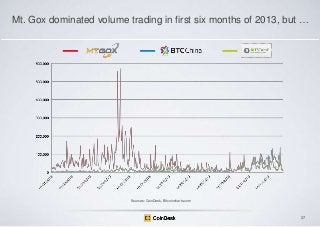

- 37. Mt. Gox dominated volume trading in first six months of 2013, but … Sources: CoinDesk, Bitcoincharts.com 37

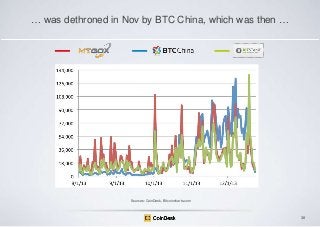

- 38. … was dethroned in Nov by BTC China, which was then … Sources: CoinDesk, Bitcoincharts.com 38

- 39. … dethroned by Bitstamp in December Average* Median* 1 23,936 14,997 2 20,327 12,782 3 15,209 7,051 *Average and median daily bitcoin volume for the period from 18 Dec 2013 - 6 Jan 2014 Sources: CoinDesk, Bitcoincharts.com 39

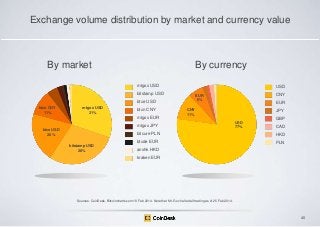

- 40. Exchange volume distribution by market and currency value By market By currency mtgox USD USD bitstamp USD btce USD btcn CNY 11% mtgox USD 31% btcn CNY mtgox EUR EUR JPY CNY 11% mtgox JPY btce USD 20% CNY EUR 6% GBP USD 77% CAD bitcure PLN btcde EUR bitstamp USD 28% HKD PLN anxhk HKD kraken EUR Sources: CoinDesk, Bitcoincharts.com 18 Feb 2014. Note that Mt. Gox halted all trading as of 25 Feb 2014. 40

- 41. Different types of bitcoin wallets Desktop Bitcoin-QT MultiBit Bitcoin Wallet Mycelium Coinbase Armory Electrum Blockchain Mobile Blockchain Coinbase Cloud 41

- 42. Top consumer bitcoin wallets Installs 1 Blockchain 1,277,618 2 Coinbase 970,000 3 Bitcoin Wallet* 500,000 4 Mycelium* 10,000 - 50,000 Sources: Blockchain.info, Coinbase. *Bitcoin Wallet figures provided by developer; Mycelium figures obtained from Google Play Store Jan 2013 42

- 43. Bitcoin hacks and fraud are still significant problems Oct 2013 Nov 2013 Nov 2013 $4.1m goes missing as Chinese bitcoin trading platform GBL vanishes Hackers steal $1.2m of bitcoins from Inputs.io, a supposedly secure wallet service Czech bitcoin exchange Bitcash.cz hacked and up to 4,000 user wallets emptied With many more … 43

- 44. Total number of merchants around the globe accepting bitcoin recently tripled to 3,000+ Source: CoinMap.org Jan 2014 44

- 45. Offline Online 45

- 46. Top bitcoin payment processors • 24,000 merchants (including Overstock.com) • • 20,000 merchants $2.51m in VC funding • 960,000 consumer wallets • 4,000 API applications • US bank integration • $31.7m in VC funding Sources: Company websites 18 Feb 2013 46

- 47. >$200 million has been invested in mining equipment ASIC mining manufacturers 21e6 - raised $5 million in April from Silicon Valley Who‟s Who Black Arrow ASIC Miner Cointerra – $20 million in presales Avalon Butterfly Labs Bitburner HashFast – presold $15 million worth of mining rigs Bitfury KnCMiner BitMain Mitten Mining Virtual Mining Bitmine Visionman Source: Mining equipment investment estimate from Wedbush Securities 47

- 48. Top bitcoin ATM operators BitAccess Lamassu Robocoin 48

- 49. VC and M&A activity 49

- 50. What VCs are saying about Bitcoin ― We believe that bitcoin represents something fundamental and powerful, an open and distributed Internet peer to peer protocol for transferring purchasing power. It reminds us of SMTP, HTTP, RSS, and BitTorrent in its architecture and openness. Fred Wilson Union Square Ventures ‖ ― I'm confident you will see major worldwide retailers adopting systems built on bitcoin. ‖ Jim Breyer Accel Partners 50

- 51. What VCs are saying about Bitcoin ― If the technology industry wants to change the financial services industry, it can‟t just build new services on top of existing financial services companies. ‖ ― Chris Dixon Andreessen Horowitz It is worth thinking about money as the bubble that never ends. There is this sort of potential that bitcoin could become this new phenomenon. ‖ Peter Thiel Founders Fund 51

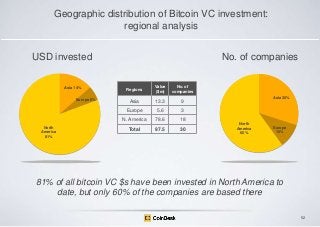

- 52. Geographic distribution of Bitcoin VC investment: regional analysis No. of companies USD invested North America 81% Value ($m) No. of companies Asia 13.3 9 5.6 3 N. America Europe 6% Regions Europe Asia 14% 78.6 18 Total 97.5 30 Asia 30% North America 60% Europe 10% 81% of all bitcoin VC $s have been invested in North America to date, but only 60% of the companies are based there 52

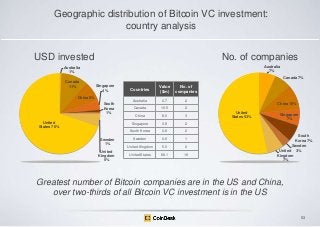

- 53. Geographic distribution of Bitcoin VC investment: country analysis No. of companies USD invested Australia 7% Australia 1% Canada 7% Canada 11% Singapore 4% Sweden 1% United Kingdom 5% 0.7 2 Canada 10.5 2 China 8.0 3 3.8 2 South Korea United States 70% No. of companies Singapore South Korea 1% Value ($m) Australia China 8% Countries 0.8 2 Sweden 0.6 1 United Kingdom 5.0 2 United States 68.1 16 China 10% United States 53% Singapore 7% South Korea 7% Sweden United 3% Kingdom 7% Greatest number of Bitcoin companies are in the US and China, over two-thirds of all Bitcoin VC investment is in the US 53

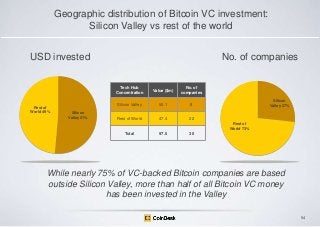

- 54. Geographic distribution of Bitcoin VC investment: Silicon Valley vs rest of the world No. of companies USD invested Tech Hub Concentration Rest of World 49% No. of companies Silicon Valley Silicon Valley 51% Value ($m) 50.1 8 Rest of World 47.4 22 Silicon Valley 27% Rest of World 73% Total 97.5 30 While nearly 75% of VC-backed Bitcoin companies are based outside Silicon Valley, more than half of all Bitcoin VC money has been invested in the Valley 54

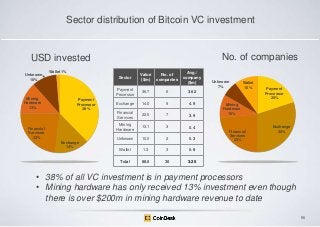

- 55. Sector distribution of Bitcoin VC investment No. of companies USD invested Wallet 1% No. of companies Avg./ company ($m) 36.7 6 3.62 Exchange 14.0 9 4.9 Financial Services 22.5 7 3.9 Mining Hardware 13.1 3 0.4 Unknown 10.0 2 0.3 Wallet 1.3 3 0.8 Total Mining Hardware 13% Value ($m) Payment Processor Unknown 10% 88.5 30 3.25 Sector Payment Processor 38% Financial Services 23% Exchange 14% Unknown 7% Wallet 10% Payment Processor 20% Mining Hardware 10% Financial Services 23% Exchange 30% • 38% of all VC investment is in payment processors • Mining hardware has only received 13% investment even though there is over $200m in mining hardware revenue to date 55

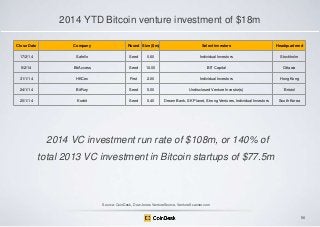

- 56. 2014 YTD Bitcoin venture investment of $18m Close Date Company Round Size ($m) Select investors Headquartered 17/2/14 Safello Seed 0.60 Individual Investors Stockholm 5/2/14 BitAccess Seed 10.00 BiT Capital Ottawa 31/1/14 HKCex First 2.00 Individual Investors Hong Kong 24/1/14 BitFury Seed 5.00 Undisclosed Venture Investor(s) Bristol 20/1/14 Korbit Seed 0.40 Dream Bank, SK Planet, Strong Ventures, Individual Investors South Korea 2014 VC investment run rate of $108m, or 140% of total 2013 VC investment in Bitcoin startups of $77.5m Source: CoinDesk, Dow Jones VentureSource, VentureScanner.com 56

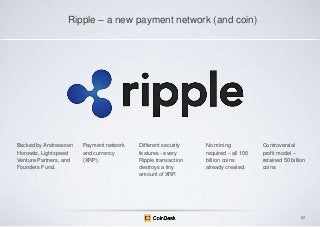

- 57. $77.5m in 2013 Bitcoin venture investment; $98m all time Close Date Company Round Size ($m) Select investors Headquartered 13/12/13 Coinsetter Inc. Seed 0.26 Undisclosed Debt/Loan New York 12/12/13 Coinbase Inc. Second 25.00 Andreessen Horowitz, Ribbit Capital, Union Square Ventures San Francisco 2/12/13 CoinJar Pty Ltd. First 0.50 Blackbird Ventures, Individual Investors Richmond, Australia 1/12/13 Bex.io / Spawngrid Inc. Seed 0.50 CrossPacific Capital Partners, Individual Investors Vancouver 25/11/13 Coinplug Inc. Seed 0.40 Silverblue Inc. Seoul 18/11/13 BTC China (Shanghai Satuxi Network Co. Ltd.) First 5.00 Lightspeed China Partners, Lightspeed Venture Partners Shanghai 17/11/13 21E6 First 5.05 Individual Investors San Francisco 12/11/13 Ripple Labs Inc. Seed 3.50 Camp One Ventures, Core Innovation Capital, Google Ventures, IDG Capital Partners, Individual Investors, Venture51 San Francisco 11/11/13 itBit PTE. Ltd. First 3.25 Canaan Partners, Individual Investors, Liberty City Ventures, RRE Ventures Singapore 7/11/13 GoCoin Pte. Ltd. Seed 0.55 BitAngels, Demarest Ventures, Individual Investors, Ruvento Ventures Singapore 31/10/13 Circle Internet Financial Inc. First 9.00 Accel Partners, General Catalyst Partners, Jim Breyer Boston 29/10/13 Coinfloor Ltd. N/A N/A Passion Capital, Individual Investors London Source: CoinDesk, Dow Jones VentureSource, VentureScanner.com 57

- 58. 2013 Bitcoin venture investment (contd.) Close Date Company Round Size ($m) Select Investors Headquartered 1/10/13 GogoCoin Seed 0.005 Dream Ventures San Francisco 19/9/13 Gliph Inc. First 0.20 Boost Fund LLC, Individual Investors Portland 4/9/13 Beijing Lekuda Network Technology Co. Ltd. First 1.00 Ventures Labs Beijing 1/9/13 Vaurum First 2.00 Boost Fund LLC San Mateo 1/9/13 Buttercoin First 1.25 Alexis Ohanian, Centralway, FLOODGATE, Google Ventures, Initialized Capital, Rothenberg Ventures, Y Combinator Palo Alto 1/9/13 Armory Technologies Seed 0.60 Kevin Bombino, Jim Smith, Trace Mayer Baltimore 19/8/13 Digital Currencies FinTech Co. First 1.25 Centralway AG, Floodgate, Google Ventures, Individual Investors, Initialized Capital, Y Combinator Palo Alto 22/7/13 Avalon Clones First 3.00 Undisclosed Investors Scottsdale 16/5/13 BitPay Inc. Seed 2.00 Founders Fund, Heisenberg Capital Atlanta 14/5/13 Ripple Labs Inc. Bridge 3.00 Camp One Ventures, Core Innovation Capital, Google Ventures, IDG Capital Partners, Individual Investors, Venture51 San Francisco Source: CoinDesk, Dow Jones VentureSource, VentureScanner.com 58

- 59. 2012 – 2013 Bitcoin venture investment (contd.) Close Date Company Round Size ($m) Select investors Headquartered 26/4/13 Coinbase Inc. First 6.11 Ribbit Capital, Union Square Ventures San Francisco 11/4/13 Ripple Labs Inc. Bridge 2.5 Andreessen Horowitz, Bitcoin Opportunity Fund, FF Angel IV, Lightspeed Venture Partners, Vast Ventures San Francisco 31/3/13 Coinsetter Inc. Seed 0.50 Bitcoin Opportunity Fund, Barry Silbert, Tribeca Venture Partners New York Mar-13 BTC.sx Seed 0.15 Joe Lee Sydney Mar-13 TradeHill Seed 0.40 Individual Investors San Francisco 7/1/13 BitPay Inc. Seed 0.51 Shakil Khan, Barry Silbert, Roger Ver, Ashton Kutcher, Matt Mullenweg, Ben Davenport, Trace Mayer Atlanta Oct-12 BitInstant First 1.50 Winklevoss Capital New York 1/9/12 Coinbase Seed 0.60 Alexis Ohanian, Y Combinator, Greg Kidd, Garry Tan, FundersClub San Francisco N/A COINFIRMA Seed 0.50 Undisclosed Venture Investor(s) Atlanta Source: CoinDesk, Dow Jones VentureSource, VentureScanner.com 59

- 60. Only two noteworthy Bitcoin M&A deals to date … Satoshi DICE acquired by undisclosed company Date: Jul 2013 Amount: $11.5m ? ZeroBlock acquired by Blockchain.info Date: Dec 2013 Amount: Undisclosed … but as the current land-grab subsides and the winners and also-rans become clear, we anticipate further consolidation 60

- 61. Technology and Mining 61

- 62. Features in forthcoming Bitcoin software release (version 0.9) Payment protocol Replaces tortuous bitcoin addresses with human-readable addresses; also enables refunds and memos (eg „payment received‟ message) Autotools protocol Makes it easier for experienced open source developers to contribute to the project Provably prune-able outputs Provide users the ability to add some new data (such as a distributed contract) to be included via a hash ―0.9 will be released … when it is ready‖ - Gavin Andresen Sources: https://bitcoinfoundation.org/blog/?p=290 and https://bitcointalk.org/index.php?topic=300809.msg3225143#msg3225143 62

- 63. Bitcoin software development roadmap (contd.) Gavin Andresen: The below will ―hopefully make it into the 0.9 release‖ Headers-First, parallel download chain sync Further optimizing downloading the block chain, will enable future work that makes downloading the entire chain optional No-wallet mode and “bitcoincli” “Disablewallet” mode, which lets bitcoind run entirely without a wallet, making startup faster and using less run-time memory Smarter transaction fees Dynamic, streamlined approach to determining transaction fees paid to miners; fees will be based on the lowest fee that will be accepted Sources: https://bitcoinfoundation.org/blog/?p=290 and https://bitcointalk.org/index.php?topic=300809.msg3225143#msg3225143 63

- 64. Other innovative uses of Bitcoin technology and the block chain Notary service Provides proof that a given document existed at a particular date/time Bonded identity service Secure identities verified by the block chain and backed by „fidelity bonds‟ Smart contracts Computer protocols that facilitate, verify, or enforce the negotiation or performance of a contract Smart property Property that can be atomically traded and loaned via the block chain 64

- 65. Network speed exceeds 14 petahashes per second, up 560x from a year ago Source: The Genesis Block Jan 2014 65

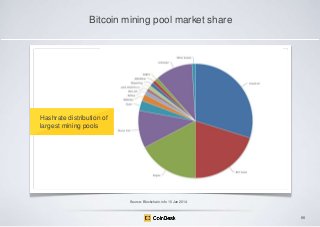

- 66. Bitcoin mining pool market share Hashrate distribution of largest mining pools Source: Blockchain.info 10 Jan 2014 66

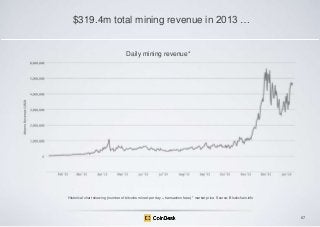

- 67. $319.4m total mining revenue in 2013 … Daily mining revenue* Historical chart showing (number of bitcoins mined per day + transaction fees) * market price. Source: Blockchain.info 67

- 68. … but mining revenue/operation is falling Mining revenue Mining work Has risen even faster, as more miners enter the fray Has risen dramatically with bitcoin’s price $6m $0 Value of all bitcoins mined per day 2011 2014 Revenue per operation 1 0 Sextillion mining operations per day 2011 2014 Has fallen $1 $0 Revenue per trillion mining operations 2011 2014 Source: Bloomberg BusinessWeek, Blockchain.info 68

- 69. Regulation and Risk Factors 69

- 70. Bitcoin is attracting significant regulatory attention around the globe 70

- 71. Bitcoin regulatory heat map Investigative Contentious Hostile Unknown Source: CoinDesk, BitLegal.net 71

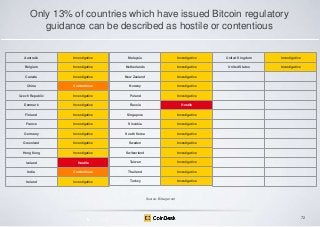

- 72. Only 13% of countries which have issued Bitcoin regulatory guidance can be described as hostile or contentious Australia Investigative Malaysia Investigative United Kingdom Investigative Belgium Investigative Netherlands Investigative United States Investigative Canada Investigative New Zealand Investigative China Contentious Norway Investigative Czech Republic Investigative Poland Investigative Denmark Investigative Russia Hostile Finland Investigative Singapore Investigative France Investigative Slovakia Investigative Germany Investigative South Korea Investigative Greenland Investigative Sweden Investigative Hong Kong Investigative Switzerland Investigative Iceland Hostile Taiwan Investigative India Contentious Thailand Investigative Ireland Investigative Turkey Investigative Source: BitLegal.net 72

- 73. Bitcoin faces numerous challenges … Regulatory uncertainty Switching costs Convenience Avoidance by traditional financial institutions Both real and perceived Convenience trumps anonymity for most consumers Slower adoption by consumers/merchants Few women involved Very few women involved in Bitcoin to date, yet women have significant and often dominant influence on financial decisions in many households Infrastructure Bitcoin technical infrastructure (ie cost, latency) Hoarding Desirability of bitcoin as a store of value works against use as a medium of exchange Source: Hileman (2013) „History and Prospects for Alternative Currencies‟, LSE working paper 73

- 74. … sentiment and movements can be difficult to sustain … 74

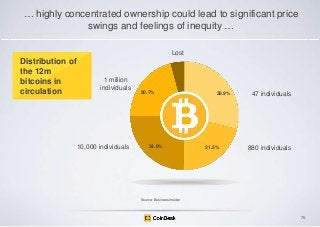

- 75. … highly concentrated ownership could lead to significant price swings and feelings of inequity … Lost Distribution of the 12m bitcoins in circulation 1 million individuals 10,000 individuals 20.7% 24.8% 28.9% 21.5% 47 individuals 880 individuals Source: Business Insider 75

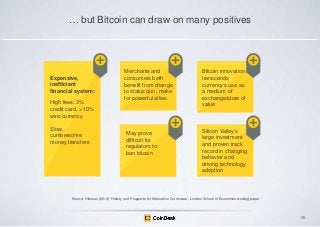

- 76. … but Bitcoin can draw on many positives Expensive, inefficient financial system: High fees: 3% credit card, > 10% wire/currency Slow, cumbersome money transfers Merchants and consumers both benefit from change to status quo, make for powerful allies May prove difficult for regulators to ban bitcoin Bitcoin innovation transcends currency‟s use as a medium of exchange/store of value Silicon Valley‟s large investment and proven track record in changing behavior and driving technology adoption Source: Hileman (2013) „History and Prospects for Alternative Currencies‟, London School of Economics working paper 76

- 77. Other Alternative Currencies 77

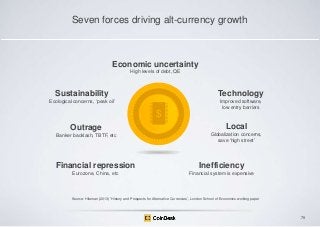

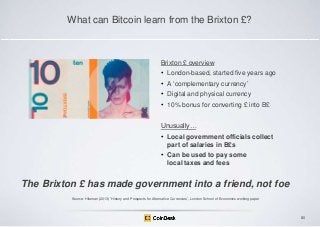

- 78. Four types of alternative currencies Digital Physical Type Historical Contemporary Intrinsic value Token Closed Centralized Open Decentralized N/A Source: Hileman (2013) „History and Prospects for Alternative Currencies‟, London School of Economics working paper 78